How Do I Sell My Business? 3 Buyout Options for a Financial Advisor

I know I need a succession plan, but where do I start?

This is the most common question we get when we have an intro call with a financial advisor. Generally, the conversation starts with talking about finding the right successor. Who would be the right fit to take over your client relationships, continue your business, and be able to properly compensate you for the equity you have built? We have detailed this out in previous blog articles and covered it in a recent Webinar. However, as important as it is to identify the right successor, knowing how you could potentially structure your succession plan is equally as important.

The first caveat I will make is there are hundreds of different ways to structure a succession plan and each one ultimately gets customized given the business and the priorities of the buyer and the seller. However, there are standard structures that we see work depending on what the seller would like to accomplish, how much longer they want to work, and the size of their business. For this example, we are going to use the example of a solo advisor who is approaching retirement with $250,000 in annual recurring GDC.

Scenario #1: Sell to another established advisor/firm, transition your clients to the new firm, and retire.

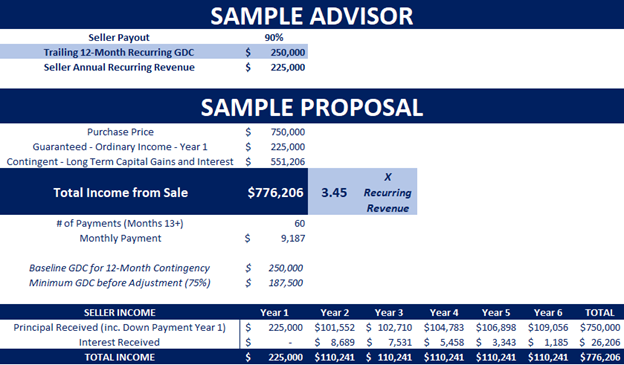

This is the most common scenario we see with our firm, as well as across the industry. In this scenario, the advisor decides that rather than identifying an internal successor, they are going to continue working with their clients, and when they decide the time is right, they will get a valuation and put their practice up for sale. This can typically be completed in less than a year from when the advisor decides to sell to finalizing the structure and transition the clients. The profile of the buyer in this case is similar- an established firm, that has processes and capacity to integrate another advisor’s business into their own. As an established firm, the buyer generally has the capital, or access to financing, to complete the purchase. Because the buyer is strictly taking over the client relationships with no expenses associated with the practice, the valuation is done as a multiple of revenue, and the buyer can easily run a cash flow analysis to determine what they can pay for the business. The deal is structured as an asset purchase of the client relationships, and the payments are structured as a combination of fixed (year 1) and contingent payments based on performance of the business. The tax treatment of these payments depends on the scenario and the activities that the seller will be participating in. However, we often see the first year fixed payment paid as 1099 with the ongoing payments as capital gains. The buyer and the seller agree to a transition period (3-6 months), in which the seller makes client introductions to the buyer, along with a knowledge transfer. The more thorough this transition is, the better for the buyer and the seller because it generally leads to high client retention. Higher retention results in higher revenue to the buyer and helps ensure the seller does not receive a negative adjustment on the purchase price. Once the transition is complete, the seller fully retires and can give up their licenses and leave the business. One final note, if the buyer and seller are part of the same firm or broker-dealer, then there is usually no repapering required. However, if they are with a different broker-dealer, there will be repapering and client signatures required. Here is a sample illustration of how the buyout could be structured for this scenario:

Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary.

Scenario # 2: Identify an internal successor, have them join your firm while running independent practices, and sell your business to that advisor when you are ready.

This scenario is the most common example of an internal succession plan. The seller identifies a younger advisor, with similar experience, business vision, and someone whom they see as a long term fit with their clients. If the advisor is joining to ultimately be the successor, we often see the structure and timeframe of the buyout agreed upon when the buyer joins and outlined in a Letter of Intent (LOI). This is an important step for both the buyer and seller because it outlines when the seller is going to retire, easing uncertainty that is often associated with succession plans. The time frame for this type of internal transition is generally longer than scenario #1, with the ideal time frame being 3-5 years from when the buyer joins the firm to when the succession plan is implemented. This scenario provides the seller with the opportunity to begin introducing the buyer to their clients early on, in some cases participate in meetings. This greatly reduces the risk of client attrition when the sale is completed. The buyout can still be structured as an asset purchase; however, there is also an evaluation of other assets and liabilities associated with the practice. The purchase price is normally based on the profitability of the company, and not simply the revenue. The payments are structured as a combination of fixed and contingent, based on performance of the business, but often with less of a focus on the contingency because the buyer already knows the clients. There is also the potential for a variable component if the seller wants to stay involved and licensed after the sale. Tax treatment can be negotiated between the buyer and seller and are part of the agreed upon structure, depending on activities performed by each party. We have seen that getting an annual business valuation leading up to the sale provides a good benchmark for the buyer and seller to determine the ultimate purchase price. The overall multiple of the business is also generally higher because the sale and transition happens over several years, allowing the buyer more flexibility with their cash flow, while providing the seller a higher overall value for their business. Here is a sample illustration of how the buyout could be structured:

Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary.

Scenario #3: A business partnership is formed between two advisors, with one advisor designated as the ultimate successor.

This scenario has become more common for advisors with a longer timeline (5 years minimum), who understand that while they need to have a successor for their business, they can continue to grow and scale their business, making it more valuable when they do decide to sell. When two advisors decide to merge their businesses, it is generally because they have similar size practices. If the practices are generating different amounts of revenue, a simple way to determine ownership percentage is based on the revenue each advisor brings to the business. After completing the merger, revenue and expenses can be split based on the owners’ respective percentage. The advantages of this scenario are it instantly gives the firm more scale, while allowing the advisors to consolidate expenses and invest in growth. The partners can run annual business valuations to establish their equity based on the ownership percentage, which also provides a structure by which other advisors can buy into the business down the line. When the seller is ready to sell their portion of the business, the overall business is valued, and the other owners buy out the seller’s portion. This structure allows for longer term buyouts and equity transfers that will truly maximize the business value for a seller.

Here is a sample illustration of how a partnership could be structured:

Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary.

These three examples are very different, but we have seen a variation of each being used, depending on the selling advisor’s time frame: less than one year for scenario one, 3-5 years for scenario two, and 5+ years for scenario three. If you are looking for more specifics on how purchases are structured and how certain factors affect the purchase price, we have provided 3 different case studies on our Realize Your Equity section of our website.

There are several factors that will contribute to the structure that you choose for your business but understanding your options will help you determine where to start.